Recording

Protect Yourself Against Property Fraud

Subscribe to our free Document Alert service today by setting up an

account at idocmarket.com and select our county for more information.

What is property fraud?

Property fraud is a growing white-collar crime where thieves record documents against your property in an effort to establish ownership for financial gainHow can I protect myself?

Be vigilant and subscribe to our free Document Alert service.- How does Document Alert work?

Document Alert sends you an automated email alert any time a document is recorded in our office using your name or property’s legal description. You then decide if the recording is legitimate or fraudulent and take the necessary actions.

Searching Public Documents:

Colorado Revised Statute 30-10-101 (2.5)(c) does not allow the Clerk’s office to conduct real estate record searches.

Recording Fee's:

Copy Fees:

Standard Size - $0.25 per page

Retrieval - $2.00

Email - $3.00

Certified Copy - $1.00 + $0.25 per page

Search and Retrieval (R&R) - $41.37 per hour (First hour is Free) - Colorado Revised Statute 24-72-205(6)

Certified Copies are NOT electronically transmitted. If a certified copy is requested, we will process the document in our office and physically mail it to you. Before mailing the document, we will contact you for a verbal confirmation and verification of the mailing address.

The following list is a guide to the more commonly searched documents.

Deeds | Documents that convey real estate. |

Deeds of Trust | Documents that encumber real estate. In the State of Colorado, the Public Trustee, a third party, is appointed as regulatory official. |

DD214 | Documents which state an individual's military record. |

Subdivisions | Approved maps showing the legal boundaries of lots, blocks and easements at the time of recording. |

Liens | Documents that encumber real estate by businesses or individuals attempting to collect on money due because of services rendered. |

Other | Judgments and decrees, federal and state tax liens, releases, public trustee documents, business incorporation and statements of authority and marriage licenses, for example. |

Public Search Portal:

For copy requests, please call the office at 719-846-3314 or email countyclerk@lasanimascounty.org.

Must register to view and print documents. Fees apply.

Recording Documents and Fees:

Documents can be recorded in the Clerk and Recorder’s office by mail, submission through an e-recording vendor, or over the counter. Documents are recorded in time order as received to the best of our abilities.

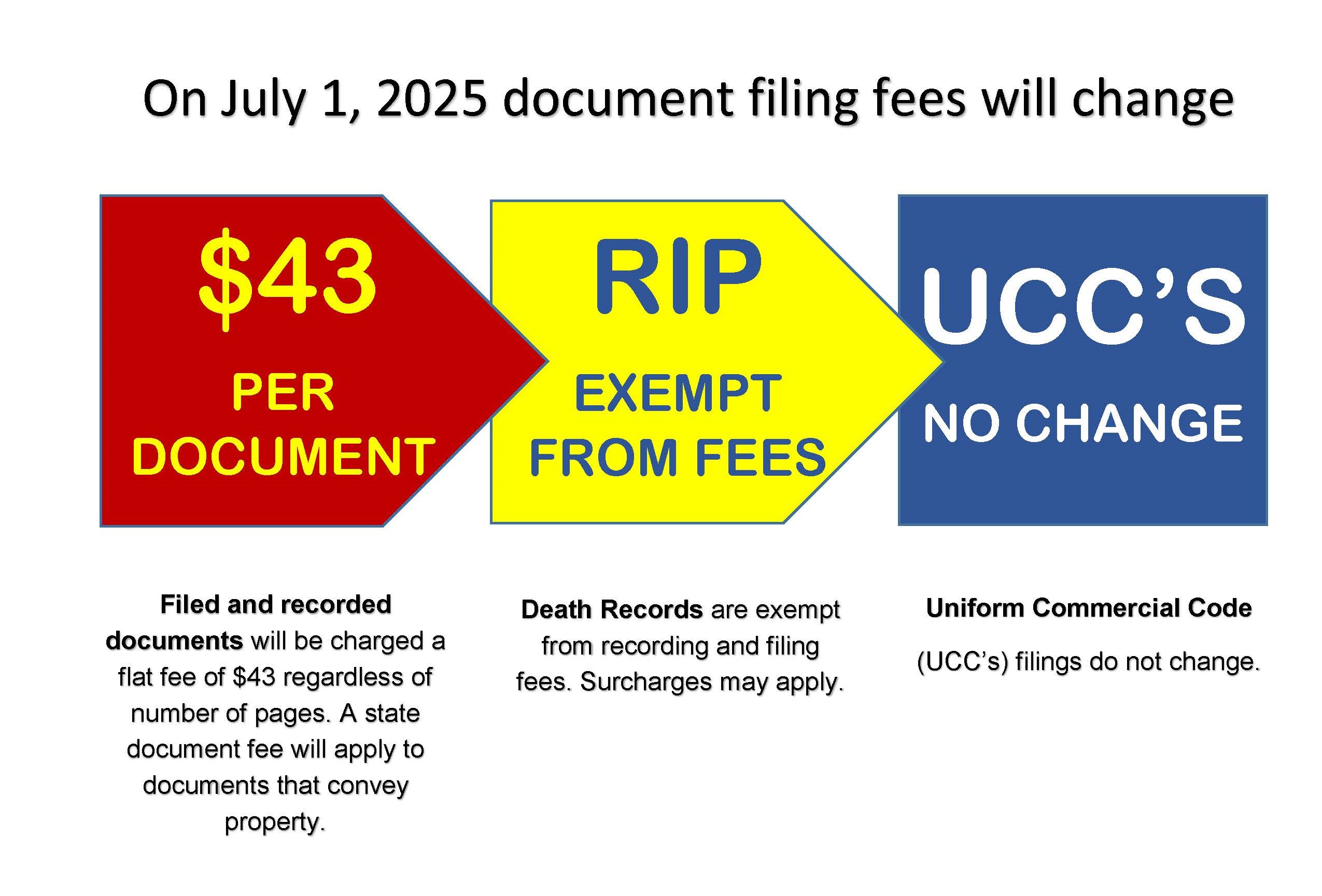

List of fees for the Recording Division - Colorado Revised Statute 30-1-103

Fees below include:

County surcharge of $1.00 - Colorado Revised Statute 30-10-421(1)(b)

State surcharge of $2.00 - Colorado Revised Statute 24-21-403(2)

- All Recording Documents - $43.00 no page count - Colorado Revised Statute 30-1-103

- Death Records - $1.00

- Federal Tax Liens - $8.00 1st page $5.00 for each addition page(s)

- UCC's - Colorado Revised Statute 4-9-525 specialized

$13.00 for one to two pages.

$18.00 for three or more pages.

$8.00 no page count limit (online only) - Military Discharge - FREE

- Survey/Plat Map - $43.00

- Survey/Plat Map - Deposit Only - $40.00

e-Recording Documents:

Las Animas County encourages everyone to e-record documents. When documents are e-recorded; the convenience, speed, and security is worth it. Online recording will offset the time, cost of paper submittals, reduces the cost of courier or postage costs, reduces rejections due to incorrect fees, increases security, and faster turn-around time.

Las Animas County currently uses the following vendors to e-record documents:

- Simplifile

800-460-5657

https://simplifile.com

Release of Military Records:

The National Archives and Records Administration has outlined certain requirements for dissemination of military records, such as the DD214 form, which this office has elected to adopt.

A DD214 request form must be filled out by any individual requesting a copy from this office.

All requests for copies of DD214s must now be accompanied by a written request form and a picture I.D. Copies will only be distributed to the veteran listed or to his or her next of kin.

Lawyers, doctors, historians, etc. may request copies of a DD214 with signed authorization from the veteran or next of kin.

Vital records, including birth, death, adoption, marriage and divorce, are confidential per Colorado state statute (C.R.S. 25-2-117). As a result, Colorado vital records are not public records and therefore not searchable online. Vital records can only be released to those who are eligible in office or you can apply for a copy online at Vital Records.

Section 30-10-406 - County clerk and recorder - duties - filing requirements

(1) The county clerk shall be ex officio recorder of deeds and shall have custody of and safely keep and preserve all the documents received for recording or filing in his or her office. As used in this part 4, unless the context otherwise requires, "document" includes electronic filings. During the hours the office is open for business, the clerk and recorder shall also record or cause to be recorded in print, or in a plain and distinct handwriting, or electronically, in suitable books or electronic records to be provided and kept in the clerk and recorder's office, all documents authorized by law to be recorded in his or her office and shall perform all other duties required by law.

(2) Upon recording any document to which a documentary fee applies, the clerk and recorder shall forward a clear, complete, and accurate copy of such document to the office of the county assessor. The clerk and recorder may forward the copy electronically to said office.

(3)

- (a) All documents received for recording or filing in the clerk and recorder's office, except a verification of application form as defined in section 38-29-102(13), C.R.S., shall contain a top margin of at least one inch and a left, right, and bottom margin of at least one-half of an inch. The clerk and recorder may refuse to record or file any document that does not conform to the requirements of this paragraph (a).

- (b) Repealed.

(4) The county clerk and recorder shall perform the duties prescribed in article 22 of title 15, C.R.S., with respect to the recording and processing of designated beneficiary agreements and revocations of such agreements.

C.R.S. § 30-10-406